Income earners in the Philippines are required to pay income taxes to the government. Taxes provide funds for the government to finance its projects and programs.

There are different taxes that every employed Filipino is required to file and pay. Of course, some income-earners need not file or pay their income tax.

The preparation of the income tax form is confusing, especially for first-time filers. You need to be familiar with some technical terms for you to fill out the form correctly.

Now, we may breathe a sigh of relief because BIR is going digital. Thanks to the Electronic BIR Forms (eBIRForms), which is downloadable on the BIR website, we can prepare our tax returns via the new application.

The eBIRForms allows the encoding of the taxpayer’s data directly to the BIR system, which automatically computes the tax dues and validates all the information before you can print the tax forms.

This new process is a convenient and advanced alternative that does away with the manual process of preparing the tax returns on pre-printed forms that are prone to error.

So, how do we use the eBIRForms?

Here is the step-by-step guide in accomplishing the income tax form using the eBIRForms package. Click to Tweet.

1. Download the eBIR Forms Offline Package Version7.6.

- Go to https://www.bir.gov.ph;

- In the Home page, click the “eBIR Forms” button to download the Offline eBIRForms Package v7.6 and follow the instruction;

- Go to your DOWNLOAD folder and install the program on your computer.

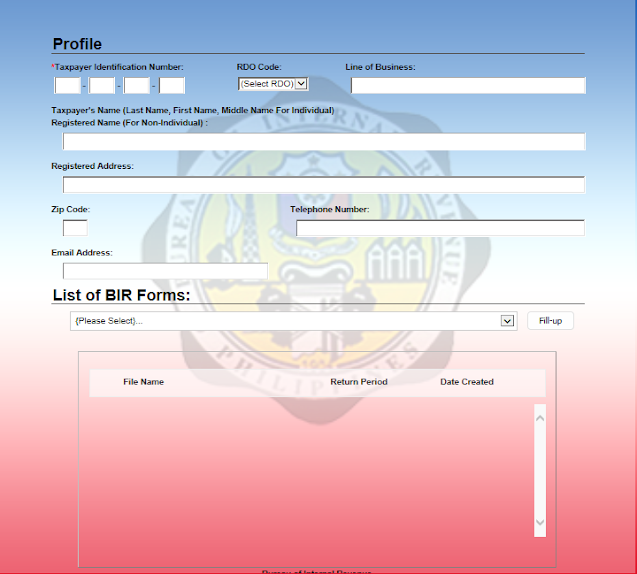

2. Access the eBIR Forms Offline Package on your computer and fill out your desired Tax Form.

- Go to your desktop and click this icon;

- Fill-out all the required data;

- Select the desired BIR Form and hit the FILL-UP icon;

- Click “OK”;

- Fill out the Form;

- Check all the data and if correct, click “VALIDATE”

Note: You should get this message if the data is correct: VALIDATION SUCCESSFUL”;

- Click “SAVE”;

- To print, click File > Print Preview >Print;

- To save the form to your desktop/cannot print at the moment, click FILE > PRINT > CANCEL PRINT and follow the instruction

3. Bring the Accomplished Form to the Authorized BIR Collecting Bank and Pay the corresponding tax due.

Updated BIR payment channels:

4. Submit a copy of the bank’s duly validated Income Tax Form to the nearest BIR Office and keep another copy for your file.

Final Thoughts

Using the eBIR Forms is easy. You need to remember just four steps: DOWNLOAD, FILL-OUT, PAY, and SUBMIT. Click to Tweet.

If you want to get help in filing your income tax, please get in touch with me through any of my social media accounts or direct message me on my mobile phone. I would be glad to help you.

Do you have helpful tips in paying your income taxes promptly? Please share them in the comment section below. I am sure a lot of us will be glad to know more tips in filing BIR taxes.

Please show us your LOVE and SUPPORT. Like, share or PIN this post.

This was a really interesting and helpful read – thanks for sharing all of this!

As a self-employed individual, this guide is definitely helpful and it's important that if you're a freelancer then you need to pay taxes as well. When filling out the forms along with the required documents, it is important to already have them fully ready when visiting the BIR office because a BIR representative will provide you with a date in which you have to come back and receive your CoR.

These are great tips on helping other Filipinos who are free lancers file their taxes properly in the Philippines or really anywhere. (Though I know you focused on the Filipino websites) I am sure it can be really easy to mess up will all the 100s of gigs a person can come up with to earn an income!

Income tax filing is a task in itself. Thankfully everything has become online these days. I liked the you have given a detailed explanation as to how to fill out the form. It will be very beneficial for income earners in Philippines.

This is a useful guide, especially for those who are in the space that could use it. Thanks for taking the time to make this.

I have been looking for something like this being a business owner. Thank you this is very helpful.

A lot of this information is pretty new to me, but I did learn a couple of things about tax filing. Thanks for the information.

This guide is what we need in filing taxes. I learned something new today, will share this too!

wowo…very informative & detailed sharing by you about income tax filing, absolutely would be helpful for freelancers & business owners. cheers,siennylovesdrawing

A lot of business owners and freelancers would definitely find this guide helpful. BIR's process can sometimes be confusing.

I have saved this for future reference. As a business owner you need to make sure you are able to file your taxes correctly.

Super amazing info for my freelancer wifey but does not apply to me as an OFW chef, thanks for sharing

This is really helpful! Tax filling is already tricky in general. I can't imagine the stress business owner experience in doing this. I'm sure this post would be really beneficial for them!

This is a helpful guide about filing taxes. As I get my biz off the ground, I will need this information!

being a freelancer I always struggle with tax filling and everything. It's to that hard to do but I always worry if I did it right. thanks so much for the guide, I am sure people like me will really appreciate it

This is very informative post for those who are looking to file their income tax returns. Tax filling is actually a tedious job, but such tips help.

Income tax filing is a task in itself and this guide is extremely helpful for the same, thank you

What an useful guide for Freelancers and Business Owners. Such great information. I hope they find they useful too.

This is truly helpful, and you are awesome for sharing this post. We should normalize on the culture of paying taxes!

This is great information! It's so important to pay those taxes and make sure we're doing all the right things when paying those taxes.

This is such a helpful guide for business owners who need to file income taxes. I appreciate the step by step breakdown. Thank you!

Taxes are a fact of life. Anything that can help make the process easier and more efficient is a good idea.

This is such a HUGE help! Being your own boss is so freeing, UNTIL you have to do your taxes. Then, it's a quagmire.

It is so helpful to have a guide when you're doing your taxes if you're self-employed. It's such a snarl of rules.

Fingers crossed on this, to be honest. Getting anything tax-related and more so, online, is a struggle here in Uganda! Thanks for sharing, though.

This is a good, effective way to make sure income taxes are paid. I don't live in the Philippines, but those who do will find this helpful.

Thank you for the guide!

These are all great tips — I will have to save for future reference!

It is important to know the right way to pay taxes. It's harder when you own your own business and have no help in the beginning.

Now this is quite the informative post you've written and thanks for sharing this with us. Definitely helpful especially to those who doesn't know much about it.

Income tax filing is a task in itself and doing it correctly is so important,

Interesting, The eBIRForms could be the best tax payment method during these pandemic days

As a new business owner, this article is extremely helpful. I am always looking for best practices on handling taxes.

Filling tax return online seems an easy way out, but still needs to understand the process n terminology carefully. You explained it well.

Useful and practical guide for freelancers as it can be tricky to handle the taxes for self-employed – Knycx Journeying

What a useful informative post. Income tax filing 8s so important

Okay back in June, I mentioned to normalized paying taxes. That is a good principle. However, as a Filipino I can't deny the fact how our taxes are being spend left and right, as if the government people owns taxpayers' money, hence, I wouldn't blame those who are uptight to pay their taxes.

Filing and paying taxes are quite easy in the Philippines. If the people feels the benefits of paying taxes, more people will follow suits.

Amazing, we needed an easy to understand guide for my sister's tax filling. This is very helpful!

I'm going to start earning from my business next year so this is great information to get ahead of the game!

This Complete Guide to Income Tax Filing and Payment for Freelancers and Business Owners is so useful. Thanks for sharing it. I'll definitely pass it around to my friends who are business owners.

Having your own business sounds really nice, until you gotta do the legal things such as taxes but this was really helpful

As a freelancer myself, it can be a daunting task to file taxes. It's one of the things we avoid but thanks for the guide

This is really helpful for freelancers and business owners like me. Thanks for sharing

This looks easy and awesome tutorial on how to do it. It will help people to do it easier. Thank you for sharing!

Fransic – https://www.querianson.com/

This is such an informative article regarding taxes. It's very important to pay taxes as citizens.