Processing your taxes can be dreadful and inconvenient, more so if you are doing it manually. Plus, because of the risk of COVID 19 infection, it is risky now going to your assigned Revenue District Office (RDO) or the Authorized Agent-Bank (AAB) to facilitate your tax transaction.

Thankfully, the Bureau of Internal Revenue (BIR) is one of the government agencies that is continuously improving its services by going paperless thru digital technology.

Tax compliance is now a breeze. Instead of enduring the long queue in the RDO or the bank, you can stay within the comfort of your homes and pay your taxes using your bank cards or mobile wallet.

What are the online channels available for taxpayers?

BIR Online Filing and Payment System

There are two e-payment options you can use to file and pay your taxes.

1. Electronic Filing and Payment System (eFPS)

The eFPS is a paperless filing and payment of taxes. It processes your transaction faster in contrast to the manual process, which is prone to errors.

The system allows you to encode, submit the return and pay the taxes due online. You can access the eFPS anywhere and any time of the day as long as you have an internet connection.

Moreover, you have to enroll in the system to use the eFPS, subject to BIR’s approval.

Only selected taxpayers are qualified to use the system: top 5,000 individual taxpayers, top 20,000 private corporations, large companies, government bidders, insurance companies, stockbrokers, and national government agencies.

How to Use the eFPS?

Here is the step-by-step guide in using the eFPS.

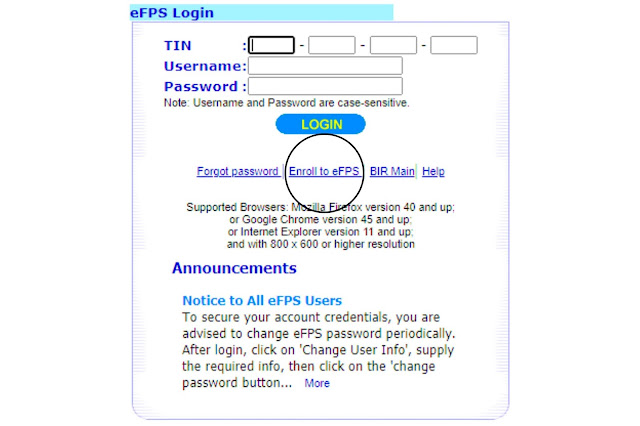

- Click the eFPS link here: https://efps.bir.gov.ph/

- Click the “Enroll to eFPS” button.

- Fill in the required fields of the Enrollment Form and click the “Submit” button. Note: The system will ask you to nominate a bank account maintained with any eFPS-Authorized Agent Bank (eFPS-AAB). So, it would be best if you enrolled your BIR credentials with the bank for you to use their e-payment system.

- Wait for the BIR email informing you of your enrollment’s approval or disapproval within 3-10 business days. If approved, you have to nominate your username and password and perform all the functions within eFPS. If unapproved, you may try online option number 2.

- To file and pay your tax due, fill-up the appropriate fields in the desired BIR Form.

- Click the “Proceed to Payment” button and fill-up the required information in the Payment Form.

- Click the “Submit” button.

- You will receive a generated Filing Reference Number (FRN) for every successful filing transaction. The system will embed the FRN at the upper right-hand corner of the return.

- You will also receive a confirmation number issued by your eFPS-AAB after the system electronically debited your account. The confirmation number is usually displayed on the eFPS-AAB e-payment facility and in the Payment Confirmation screen.

- Print and file the tax return with the FRN and the Confirmation Number for tax audit purposes.

2. Electronic Bureau of Internal Revenue Forms (eBIRForms) V 7.9

The eBIRForms is a tax preparation software that allows taxpayers to prepare and file tax returns electronically, improving BIR’s efficiency and accuracy in preparing and filing tax returns.

Taxpayers can directly encode data, validate, edit, save, delete, view, print, and submit their tax returns in the system. The package can do automatic computations and can validate information encoded by taxpayers.

How to Use the eBIRForms

Please click this link to know the step-by-step guide in using the eBIRForms.

Final Thoughts

Correctly paying our taxes is part of our responsibility as taxpayers and citizens of this country. No matter how small or big our tax payment is, this will go a long way in funding the Philippines’ various government projects.

Manage your tax worries at bay by knowing the online payment channels to pay your taxes on time.

If you need help in filing and paying your taxes, please send us a message at ramilhinolan@gmail.com.

Please show us your LOVE and CARE. Like or Share this post.

Great informative post! I think it's great that you shared this because it could benefit many people who might just be getting started to file their taxes online.

very useful information for Philippines! It helps so much to find better ways to handle your taxes

very good info for those needing to file their taxes and living in the Philippines – Denise

It's great that the government is finding ways to ease up the load of going to and fro to pay taxes.

It's always fascinating to see how other countries deal with tax collections.

It's so interesting how other countries file taxes!

oh wow! I wish we have something like that where i live, it is so convenient…

Great work,I’m currently looking for somebody to do my taxes over here!

Making sure you file taxes properly is so important. Thanks for all the useful information.

It's important to get them done timely and in the right way. I like that there are online options these days that make it easier.

So glad you have the option to pay taxes online now.

This seems really convenient and helpful. This is so interesting to read how other countries file taxes.

Electronic Filing and Payment System (eFPS) seems like an easier route. Usually, the HR does this for us. It's a good to know information though.

It is always good to have options. One cannot miss their tax filing. If they did many problems could occur.

Correctly payinh taxes is a skill everyone should learn…Thanks for this informative post…I have been trying to learn more about filing my returns and posts like these are so helpful.

efps user here. the initial process is somewhat daunting especially for corporate account. talking about linking your ebir account with your preferred bank. But once it's fully processed it will definitely make your life way easier when it comes to filing taxes.

Wow! These steps are so convenient! I've been having a hard time with this kind of things so I'm really happy I saw this.

I think I'd prefer the BIR Online Filing and Payment System as an online channel

This is very helpful and I am sure it will benefit your readers from the Philippines. It's nice to know that there are now convenient ways to file and pay taxes.

I love that we can now submit our tax returns in the system directly. Directly encoding your date, edit and save also sounds promising

I don't know much about the system in the Philippines but this is a good thing to know. Thanks for sharing

All sort of Online payments have become so useful for most of us who are short of time to visit billing counter. And making tax payment from comfort of your home is sensible, if done wisely.

Taxes are so important and many countries have come up with ways to ensure it's easy and convenient to file taxes. Thanks for throwing more light on this topic.

This is such an informative post! Tax filing is so different in every country

This is such an informative post! Tax filing is so different in each and every country