The passage of RA No. 11534, or the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, was a welcome news to small business owners and freelancers struggling to survive in the worst global economic disaster.

The new law changed the Percentage Tax rate from 3% to 1% on gross sales of goods or services for non-VAT registered businesses.

But the new bill creates confusion among taxpayers, given the significant changes in the National Internal Revenue Code, such as the lowered tax rates or the additional allowable deductions from gross income of some type of taxpayers, among others.

Amid the pandemic, when we are forced to stay at home, the BIR expects us to pay our taxes correctly and timely. Otherwise, we would end up paying tax penalties ranging from a compromise fee, 20% interest, and 25% surcharge.

How to file and pay the Quarterly Percentage Tax Using eBIR Form 2551Q

We can file and pay our taxes in the comforts of our homes with BIR’s new tax filing and payment system. All we need to have is an internet connection and funds in our bank accounts or electronic wallets authorized by the bureau to accept tax payments.

1. Download the Offline eBIRForms Package Version 7.9 on the BIR website;

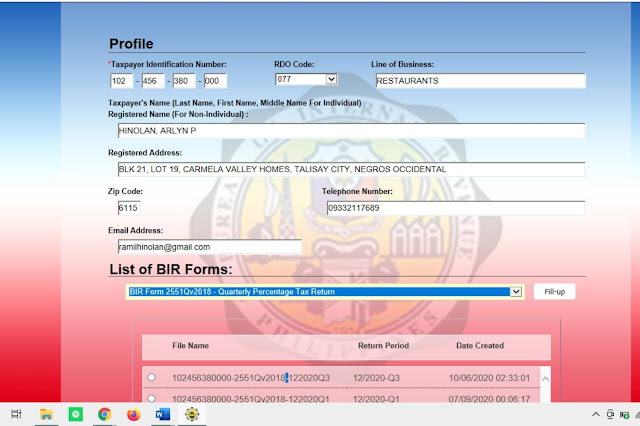

2. Access the file and fill in the Taxpayer’s Profile, such as taxpayer’s personal information, TIN, RDO, etc.;

3. Select BIR Form 2551Qv2018 Quarterly Percentage Tax Return in the List of BIR Forms and click “Fill up”;

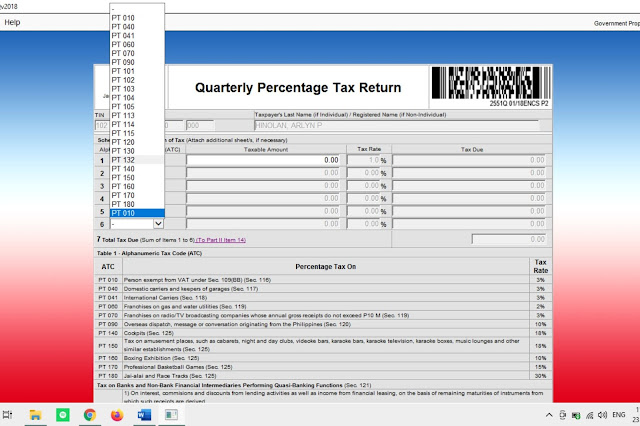

4. Fill up all the required information on the form. On the second page, click on the drop-down menu for ATC Code and scroll down to the last option. Select PT 010.

There are two PT010’s. Do not select the first PT 010 of the drop-down menu because it would lead you to the 3% PT rate

Once you key in the taxable income, the BIR system will automatically compute your tax due. There is no need for manual percentage tax computation nor percentage tax calculator to know how much you should pay to BIR.

5. Click “Validate” to check the correctness of your data and click “Save”;

6. Tap “Print” if you wish to print and “Submit Final Copy”;

Note: You are not allowed to modify/edit the form up to this point.

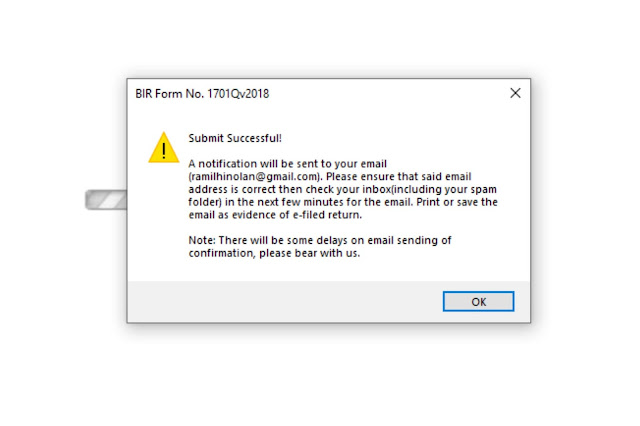

7. Check your email for the BIR confirmation, informing you that they have successfully received the form;

8. Access your mobile banking account or your e-wallet to pay the tax due.

9. Refer to this link to know the payment channels accepting tax payments.

LIKE this post? PIN IT.

Final thoughts

For micro entrepreneurs and freelancers, dealing with BIR and taxes is a challenge. The implementation of RA 11534 weeks before the deadline of the filing and payment of annual income tax and some quarterly tax payables made the problem even more stressful.

By updating ourselves with the latest BIR rulings and how we can complete our transactions on time and in a safe manner, we may keep our tax worries at bay.

Please show your LOVE and SUPPORT. Like or Share this post.

i am sure this will a relevant article to many of us who struggle with this concept. Thanks for explaining in clear and lucid words

very useful post. It is always handy to have a simple guide

I recently did it. Thanks for the details here.

I have never did online filing. I might think about it next year.

What a great guidelines on how to Filing and Payment of the Quarterly Percentage Tax for freelances I'm surely this tips would help a lot awesome!

Obviously between Italy and the United States the payment of taxes is very different, the fact remains that I like to read about it and stay informed.

I lvoe these posts, so informative. I get a lot out of them as I am, a newbie to the world of business!

What a new way to file and complete filing taxes through online processing. This is very informative!

Such a complex topic. Thanks for sharing your tax knowledge!

Thanks for the all the information. Very interesting and useful post.

If I ever need to know how to do quarterly taxes I will be following this. You made it sound so simple and easy.

This is great! I needed information on quarterly filing

Great information for small owners. Filing taxes are fun but they are a headache.

This is an exceptionally helpful information. I'm glad that most establishments are now shifting to online because it saves a lot of time and not to mention that it's a lot safer these days.

I like this Complete Guide to Online Filing and Payment of the Quarterly Percentage Tax (BIR Form 2551Q) for Small Business Owners and Freelancers! So very well detailed. Thank you for the information. It's really helpful!

I'm working as freelancer, sure dealing with taxes is a challenge. The app looks interesting and could be helpful. Thanks for the guide

Train Law.. Less collections because of it..

I get a little bit panic just looking at the forms and numbers and tags and thanks for the guides and tips that would think people like me their lives much more easier.

This is good news to small business owners. I love that you can do everything online now. So convenient! I will let my friend know about this.

You've explained this so even I could understand it. Taxes and information about them are usually way over my head.

This information must be quite helpful to entrepreneurs in your country.

[…] should still file the tax return even if he has no tax payment for the quarter. Related: How to file tax return and pay income tax? What are the penalties for non-payment of tax dues? Section 254 of the tax code punish […]

Yes, you should still file your tax return even if you have zero tax dues. Otherwise, you wound end up having open cases and you will be asked to pay penalties.