PESONet and instaPay are electronic fund transfer system with bank fees and charges. Using this inter-bank platform will allow clients to experience the convenience of banking within the comforts of their homes.

But it is not for free. Selected banking institutions charge their clients with interbank transactions fees when using the new payment platform. Service fees range from 15 pesos to 500 pesos, depending on the institution.

Related Post: How to Avoid the Convenience Fee When Cashing-in your Gcash Wallet

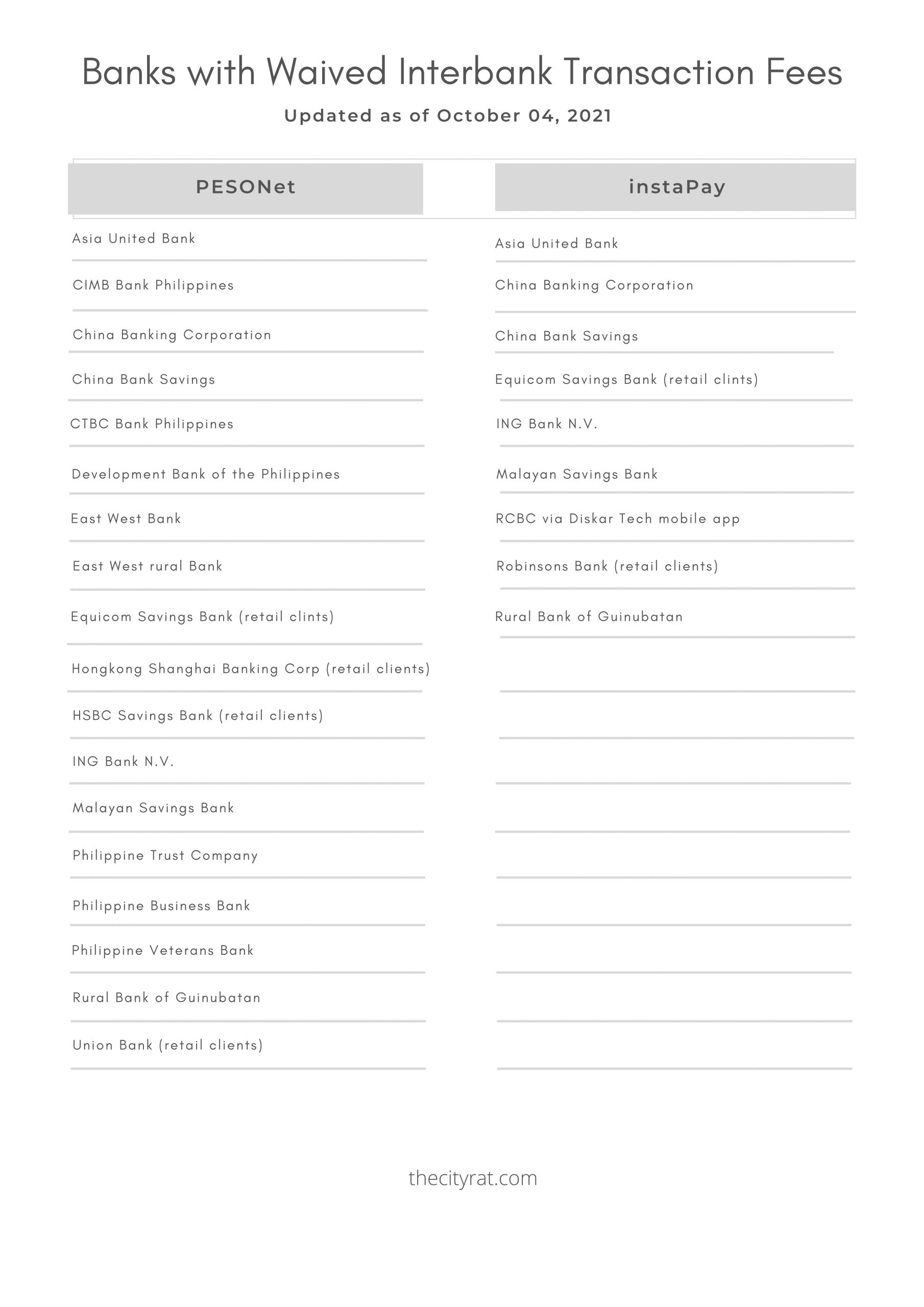

For average-income earners like us, the bank fees and charges are added dent to our depleting resources. Thankfully, some banks waived their charges until December 31, 2021. The list of these banks is found below.

List of Banks with Waived Bank Fees and Charges

PESONet VS instaPay

Let’s have a little background about this newest innovation. PESONet and instaPay are both electronic platforms for interbank fund transfers. But they differ in many ways.

PESONet was designed to cater to transactions involving significant and non-urgent transfers, like payroll crediting. InstaPay on the other hand, is ideal for transferring small amounts, requiring real-time crediting.

Who shoulders the bank fees and charges?

But, here’s the catch. Financial institutions may charge bank fees and charges to the sender of funds. The payee, meanwhile will receive the proceeds in full and shall not be charged for the transferred funds.

In the spirit of transparency, banks and other financial institutions must disclose to the Bangko Sentral ng Pilipinas (BSP) the details of all their interbank charges s they will impose to their clients. In effect, banks may not just indiscriminately burdened their clients with undue bank fees because the BSP controls and supervises the operation of financial institution in the country.

Final Thoughts

We have so many options when it comes to our banking needs. We should appreciate the BSP and all the financial institutions for this kind of initiative. The inter-bank transaction facility is a big help especially in this trying time.

As a word of caution though: Let us be wary of the banks offering extra services. We might pay additional bank charges and fees for the extra service.

May the list above will help us schedule our banking transactions in such a way that we can avoid unnecessary bank expenses.

[…] Related Post: List of Banks who Waived their Interbank Fund Transfer Fee […]

[…] Related Post: List of Banks that Waived the Inter-bank transfer Fees […]