Your obligation as a taxpayer doesn’t end after you have registered your business to the Bureau of Internal Revenue (BIR). In fact, your work has just begun. The social media influencer’s taxes, filing and payment are some of your obligations.

Aside from business registration, you have to maintain and keep the books of accounts, file and pay your taxes correctly and timely and act as a tax withholding agent.

Now, are you confused or overwhelmed with the barrage of information you have to deal with because of the recent BIR circular?

Fret no more because we will be discussing all the taxes that should be filed and paid by social media influencers.

You don’t need to be an accountant to file and pay your taxes correctly.

Social Media Influencer’s Taxes: Tax Types and Deadline of Filing and Payment

Generally, Socmed Influencers need to file and pay two types of taxes:

1. Income Tax – is a tax on all your earnings, whether cash or in-kind as a digital content creator or influencer.

BIR FORM DEADLINE OF FILING

1701Qv2018 (Quarterly) May 15 for the 1st quarter

August 15 for the 2nd quarter

November 15 for the 3rd quarter

1701v2018 (Annual) April 15 of the following year

2. Percentage Tax – is a business tax imposed on your gross earnings.

BIR FORM DEADLINE OF FILING

2551Qv2018 (Quarterly) 25th of the month following the close of the taxable quarter

Allowable Deductions

In the computation of the taxable net income, taxpayers may select the 40% Optional Standard Deduction (OSD) or Itemized Deductions. This is only allowed if the taxpayer prefers the Graduated Tax Rate in the computation of income tax.

1. 40% Optional Standard Deduction (OSD)

Under the 40% OSD, the taxpayer multiplies the total gross income to 40% and deduct the result to the gross earnings to get the taxable net income.

Example: Influencer X has a total annual income of 300,000.00

Computation of Income Tax: Gross Income P300,000.00 Less: 40% OSD 120,000.00 Net Taxable Income 180,000.00

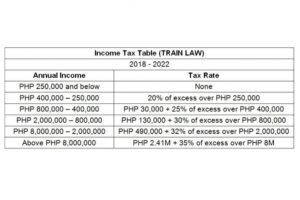

Tax Due: Influencer X has no tax due for the year because his Net Taxable Income is less that P250,000.00. Please see the Tax Table below.

2. Itemized Deduction

In the Itemized Deduction, the taxpayers deduct the allowed business expenses to the total gross earnings to arrive at the taxable net income.

Business expenses allowed as deductions include the cost of filming and computer equipment, software subscriptions, internet expenses, transportation, among others. These expenses should be supported by BIR-registered receipts.

Example: Influencer X has a total annual income of P300,000.00. He has business expenses of P100,000.00 (Computer – P30,000.00; software subscription – P20,000.00; internet and other communication expenses – P15,000.00; transportation – P45,000.00)

Computation of Income Tax: Gross Income P300,000.00 Less: Business Expenses Computer Equipment 30,000.00 Software Subscription 20,000.00 Internet and other com 15,000.00 Transportation 45,000.00 Total Expenses P100,000.00 Net Taxable Income P200,000.00

Tax Due: Influencer X has no tax due for the year because his Net Taxable Income is less that P250,000.00. Please see the Tax Table above.

Social Media Influencer’s Tax: Tax Rates

BIR adapts two kinds of tax rates in the computation of Income Tax – either the Graduated Tax Rates or the 8% income tax from gross sales.

1. Graduated Tax Rates

If you prefer the Graduated Tax Rates, you simply need to know your net taxable income. Then compare it from the Table below to determine the income tax you should pay the BIR.

2. 8% Income Tax Rate

For the 8% income tax rate, get your gross sales or earnings and multiply the amount to 8%, and voila, you will have your income tax amount due to the government.

FINAL THOUGHTS

It is time to register your business as a social media influencer. You have all the aces if you are a registered taxpayer. Aside from having peace of mind, you will have the opportunity to get established brands to work with you.

These big companies usually ask for Official Receipts from people they work with.

Moreover, getting a loan or applying for a visa application may no longer pose a problem. Your BIR documents guarantee that you are a legitimate business with regular income, so you have higher chances of approval for a bank loan or visa application.

If you have issues in registering your business or have difficulty in filing and paying your income tax, please share it in the Comment Section below. I am glad to help you with your BIR problems.

[…] Related Post: Social Media Influencer’s Taxes/ Filing and Payment […]