Learn how to compute your annual revenue to optimize business opportunities and for income tax payment purposes.

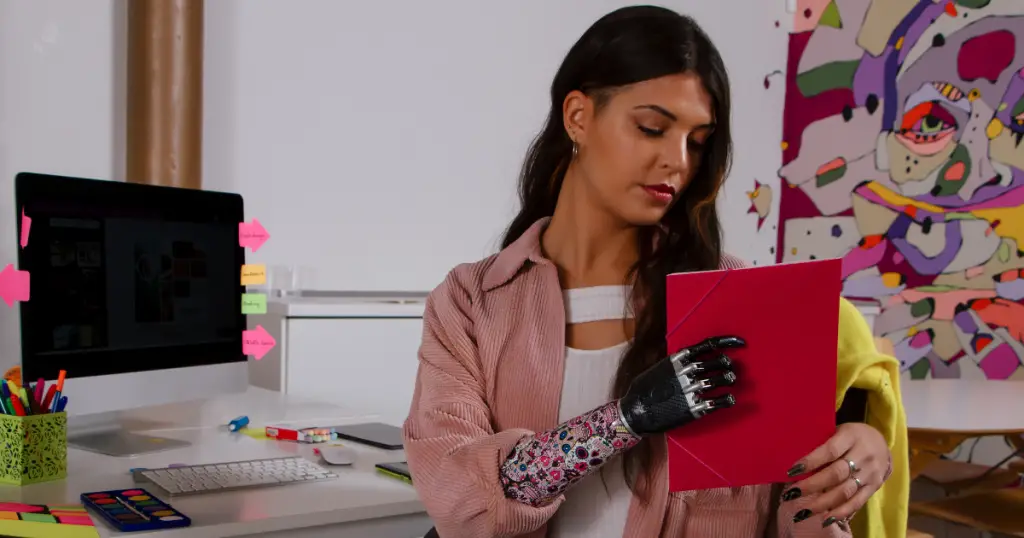

The rise of digital platforms and social media has created new opportunities for individuals to monetize their creativity and build a career as a digital creator.

Digital creators use online platforms to showcase their talent and generate revenue from various sources such as sponsored content, merchandise sales, affiliate marketing, and subscriptions.

As a digital creator, it is essential to track and compute annual revenue accurately to determine the growth and success of the business and to pay our income tax accurately.

Understanding how to compute your annual revenue can help you make informed business decisions, optimize your revenue streams, and ensure compliance with relevant tax laws and regulations. Here’s a guide on how to compute for annual revenue for a digital creator:

Determine the sources of revenue: The first step in computing the annual revenue of a digital creator is to identify all the sources of revenue. Digital creators can earn money from multiple sources, such as sponsored content, affiliate marketing, ad revenue, merchandise sales, and subscriptions.

Gather financial statements: The next step is to gather all the financial statements related to the identified revenue sources. This can include invoices, receipts, bank statements, and other financial documents.

Issue invoices and record transactions: Once revenue is generated, it is essential for digital creators to issue invoices and record transactions in their books of account. This ensures that all revenue is accounted for and can be tracked for tax purposes.

Calculate revenue from all income sources: If the digital creator has sponsored content on their platform, engages in affiliate marketing, generates ad revenue, sells merchandise, or offers subscriptions, calculate the total revenue based on invoices and bank statements.

Deduct any expenses: Finally, deduct any expenses related to the digital creator’s business, such as production costs, marketing expenses, and platform fees. The final amount is the annual revenue earned by the digital creator.

Final Thoughts

Computing annual revenue is a crucial aspect of a digital creator’s business. By accurately tracking and calculating revenue from various sources and deducting expenses, digital creators can make informed decisions and optimize their revenue streams.

It is important to note that the taxation laws and regulations vary by country and jurisdiction, and consulting with a professional tax consultant or accountant is recommended to ensure compliance.

As the digital landscape continues to evolve, it is important for digital creators to stay informed and adapt their business practices accordingly to thrive in the competitive digital economy.

By following the steps outlined in this guide, digital creators can effectively compute their annual revenue and gain insights to grow their business and achieve long-term success.

So important to keep track of earnings and expenses as a creator! This is a great resource for anyone just starting.

This is awesome actually, I am clueless as to how to organize my different revenue streams, it is a bit confusing to me. Thanks a lot for the insights, they’re great.