The fight to stop the pandemic isn’t over yet. While most of the alert levels were lowered by the government, we still need to wear masks, avoid mass gatherings, and maintain social distancing.

It’s tax season now. With the anticipated volume of taxpayers gathering at their respective Regional District Office (RDO) on the deadline of tax filing, there is a probability that another may infect some.

So, the Bureau of Internal Revenue deemed it necessary to allow the taxpayers to submit the Audited Financial Statements and other attachments online via the eAFS portal.

This way, taxpayers will not have to go to the BIR Office to have their ITR, SMR, and other BIR forms stamped “RECEIVED BY,” thus, contamination is avoided.

What is an Electronic Audited Financial Statement (eAFS)

eAFS is an online facility of BIR that enables taxpayers to submit their tax returns and attachments on time in the comfort of their homes. Taxpayers don’t have to personally go to BIR to have their tax returns stamped “Received by”.

How to Create an eAFS account?

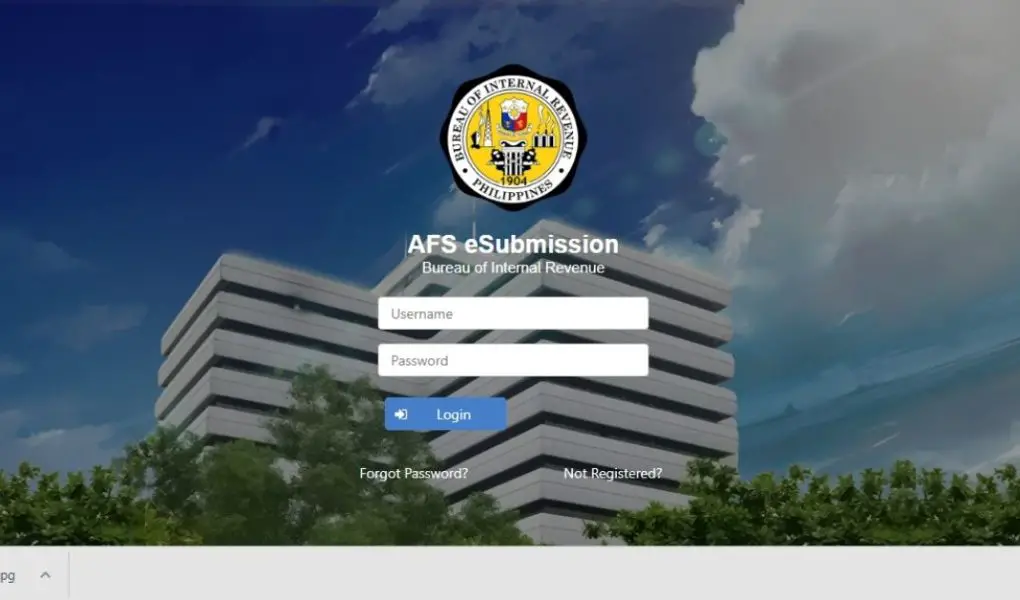

- Click the eAFS icon found on the BIR homepage.

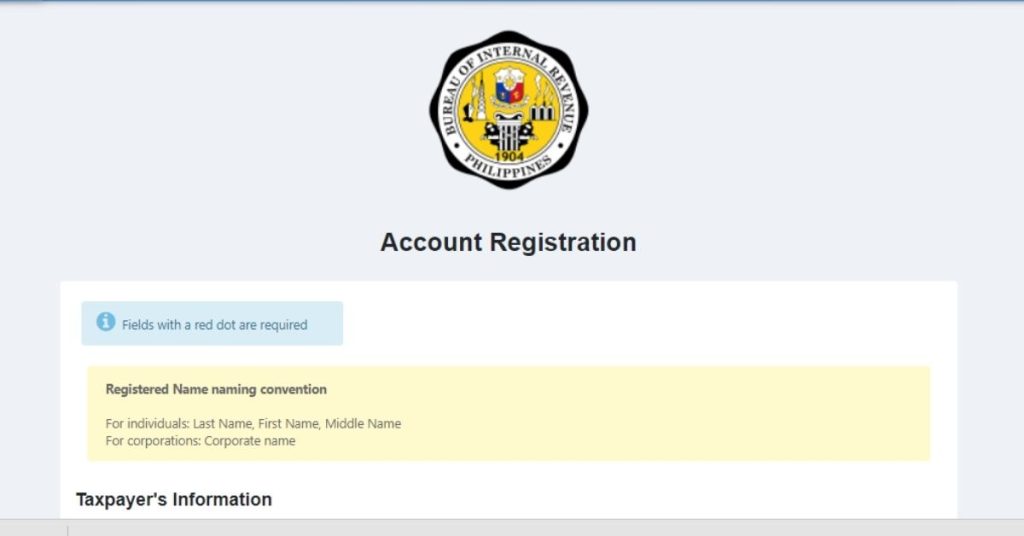

- Tick the ‘Not Registered” button to create an account;

- Fill in the information as it appears on the screen and follow the naming convention of the Registered Name and the password policy;

- Hit the “Submit” button;

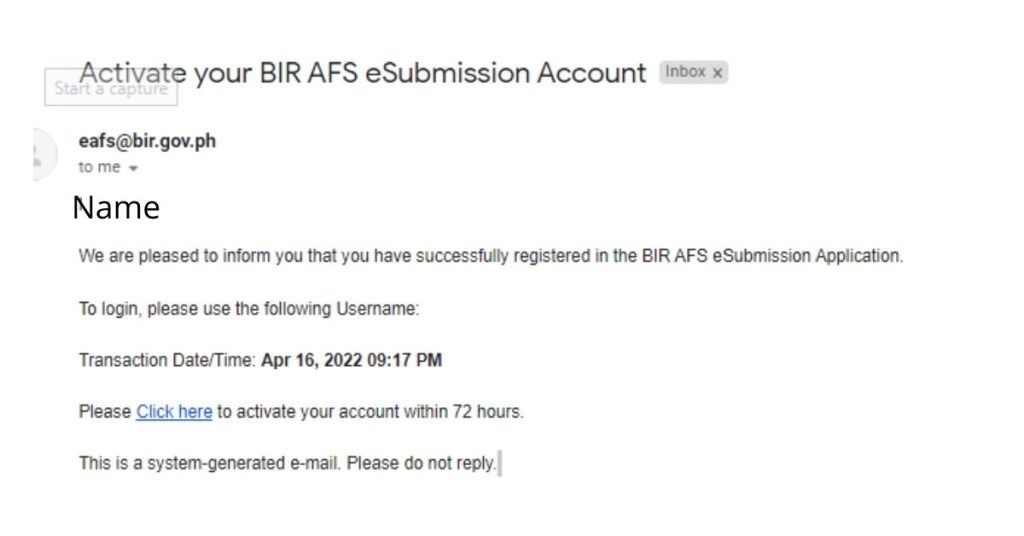

- Go to your registered email and click the activation link;

How to Upload a document to eAFS

- Go back to the eAFS and log in with your new account credentials;

- Click “File Upload” at the upper left of the main screen;

- You can upload these files and follow the file’s naming convention:

| Forms | Naming Convention |

| Income Tax Return (ITR) | EAFSxxxxxxxxxITRTY2021.pdf |

| Audited Financial Statements (AFS) | EAFSxxxxxxxxxAFSTY2021.pdf |

| Form 1709 (RPT) | EAFSxxxxxxxxxRPTTY2021.pdf |

| Others (OTH) | EAFSxxxxxxxxxOTHTY2021.pdf |

| Tax Credit (TCR) | EAFSxxxxxxxxXTCRTY2021-XX.pdf |

Note: where “xxxxxxxxx” is the taxpayer’s TIN / for Tax Credit, where xx is a two-digit number from 01-99

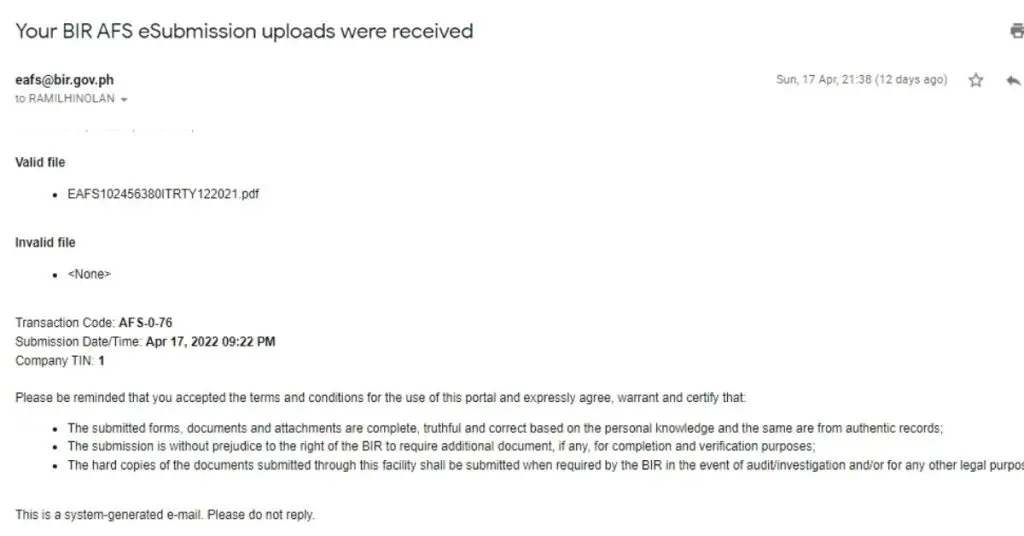

- When you have finished uploading all the documents, click “SUBMIT”;

- Click “Accept” on The Statement of Undertaking to proceed;

- Go over to your inbox and print BIR’s message indicating they have successfully received your attachments.

Final Thoughts

This new process of filing the ITR online is relevant at this time, more than ever. We highly urge you to support this project as we face life in the new normal

I’ve never heard of eafs, I had no idea you could do it online. That is amazing amazing…

thanks for sharing.. this is very helpful not just for me but for others too

Very informative and love the step-by-step instructions. Filing taxes can be so confusing, but this definitely helps.

Surely it is very specific information that for those who find themselves facing it need a good guide like this!

This is going to help so many people. Taxes are soooo confusing. Even forms can make your head spin.

Very useful for people with limited financial knowledge. Thanks for sharing all the details about how to create and upload BIR documents

I am sure many people will take advantage of this service. Thank you for the step by step directions. That is very helpful.

Wow, that’s a lot of acronyms I’ve never even heard before! I always file my taxes online early and have never had to go in person. But I was doing that long before the pandemic. We have no restrictions here in Texas, it’s business as usual everywhere I go.

This is the new normal. Processing things like ITR online has become convenient. Thanks for sharing this.

how useful! We should have more guides like that so it’s easier to navigate life and documents. I always have a hard time with it

It’s so important to know this information.

I’ll have to read more about this. I’ve never been audited but I know some people who have, so I will share this information for sure!

Thank you for such informative information regarding this process. I’ll be sure to share this with friends and family that want more details regarding this.

I was not familiar with this process. It is nice to learn more about creating and submitting these documents. I do like doing things online versus in person when possible.

This is so good to know! Thank you for your thorough instructions. They were very helpful.

Thanks for sharing.. Most of us need a little push in this area.

I had no clue how to do that. Thank you for the in-depth tutorial.

This is a very helpful guide. I need to learn more about tax, this guide really showed me the way.

I had my ITR filed the old school way hehe. I wasn’t aware that this can now be done online. Thanks for this info! This is totally different from EFPS yes?

Hi Kat, EFPS users are usually corporate taxpayers. For self-employed, we use offline eBIRForm, which is downloadaed at the BIR website.

Good thing the online submission provides an ease to every taxpayer. No need to travel and line up.

I learned something new today! I never heard of the eAFS Account it was really informative and there is a lot of good info! This is extremely helpful as it was really easy to understand.

This is very timely and helpful, especially for those who are not familiar with the process of online submission. Thank you for these tax compliance guides.

I didn’t even know about this kind of account. Thank you so much! Doing things online helps so much!

This post is sure to help so many.. Having an expert show the way across tax documents and details makes things so much easier for this critical task