Tax compliance Philippines / Audit-proof your business. Learn how proper record-keeping can help you stay compliant and avoid penalties

As a business owner, one of your most important responsibilities is to ensure compliance with tax laws. In the Philippines, this means keeping accurate records for the Bureau of Internal Revenue (BIR). Not only is this a legal requirement, but it can also save you a significant amount of money and hassle in the long run.

Report income and expenses to BIR accurately

One of the main reasons why keeping accurate records is so important is that it allows you to accurately report your income and expenses to the BIR. This means that you can claim all of the deductions and credits that you are entitled to, which can lower your tax bill. However, if you don’t have accurate records, you may end up paying more in taxes than you need to.

Avoid penalties and interest for tax compliance Philippines

Another important reason why keeping accurate records is crucial is that it can help you avoid penalties and interest charges. The BIR can impose penalties and interest on any taxes that are not paid on time, or if you underreport your income. By keeping accurate records, you can ensure that you are paying the correct amount of taxes, and that you are doing so on time.

Respond to BIR audits immediately

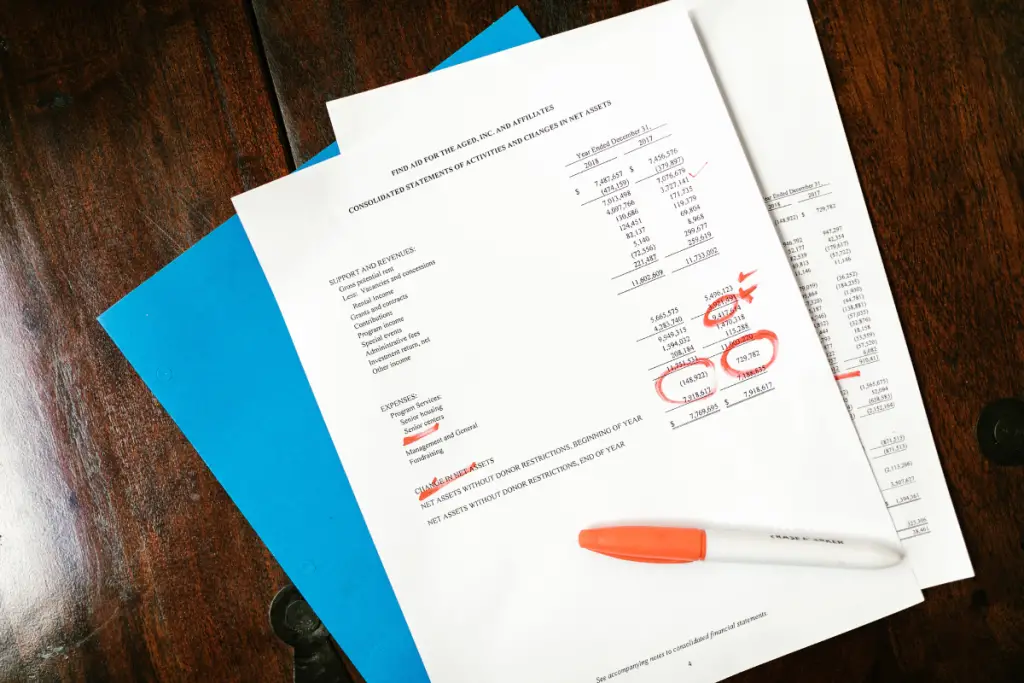

Moreover, keeping accurate records can also make it easier for you to respond to BIR audits. The BIR may conduct audits to ensure that businesses are complying with tax laws, and if you don’t have accurate records, it can be difficult to prove that you are in compliance.

By keeping accurate records, you can provide the BIR with the information that they need to quickly and efficiently complete the audit.

Document transactions properly

Another important aspect of keeping accurate records for BIR tax compliance Philippines is the proper documentation of transactions. This includes keeping invoices, receipts, and other documents that show the details of your income and expenses. It is important to retain these documents for a certain period of time, as the BIR may request to see them during an audit.

In addition to keeping physical records, it is also important to keep digital records. This can include digital copies of invoices and receipts, as well as electronic records of your financial transactions. Keeping digital records can make it easier to access the information that you need, and can also help to protect your records in case of fire or other disasters.

Keep records organized and easy to access

Furthermore, keeping accurate records is to ensure that they are organized and easy to access. This means that you should have a system in place for storing and categorizing your records, so that you can quickly and easily find the information that you need. This can include using a software system or spreadsheet to track your income and expenses, or using a physical filing system to organize your documents.

Final thoughts on Tax compliance Philippines

Keeping accurate records is an essential part of BIR tax compliance. It allows you to report your income and expenses accurately, avoid penalties and interest charges, and make it easier to respond to audits.

So, it’s very important for business owners to take the time to organize and maintain their records properly.

No matter where we live, keeping our financial documents up to date and right is so very critical.. Luckily for me, my spouse manages this 🙂 though I try to get myself updated on stuff every so often so I am aware of things too

The rules in every country is more or less the same. But yes, these were a important reminder.

This is very helpful and I think anywhere would be useful to keep an accurate record. Counties that have taxes like the US.

As a former Deputy Commissioner of the BIR, I couldn’t agree more! Thanks for reminding people.

Keeping BIR records is so important and filing taxes on time is crucial.